- Armchair Insider

- Posts

- Utility Swap & Chill

Utility Swap & Chill

1 Sale, 1 Buy

A relatively quiet month for the portfolio. Switching UTG for UTF, based on relative value. Plenty of news in the financial media (AI bubble, regional bank troubles, etc). However, most news doesn’t require a change to the portfolio.

Regarding MSTY, the fund manager, Yieldmax changed its distribution frequency from 28 days to 7 days, which is confusing the yield calculations on most websites. The annualized yield per Yieldmax’s website is 80.27% as of October 19, 2025.

The current portfolio yield is 12.18%.

BDC Prices Down 10% for the Past Month

The Business Development Company (BDC) sector, known for its juicy double digit yields, declined in price 10% over the past month. This volatility naturally prompts the question: Is there a crisis brewing, or is the market simply overreacting?

The dip boils down to three primary fears. First, the expectation of aggressive Fed rate cuts, which narrow the BDCs' interest spread (until they can refinance). Second, investor panic over the bankruptcy of the auto parts company, First Brands—a situation that had zero impact on the portfolios of the major BDCs. Lastly, BDCs often get unfairly "tarred with the same brush" during regional bank issues (eg. Zion last week), despite not being banks.

Historically, quality BDCs have proven to be more resilient than the recent price drop suggests. We saw this in 2021 when the Fed Funds rate was near zero; established BDCs like ARCC and MAIN maintained their regular dividends, proving their core income streams are durable. Moreover, rate cuts aren't all negative: they encourage loan refinancing, which earns BDCs higher fees, and they reduce default risk for borrowers.

The price correction is likely just the BDC sector returning to a more typical pattern, after enjoying a temporary "sugar rush" of high special dividends, during the peak interest rate environment. If you're an income investor focused on consistent cash flow, BDC’s still offer consistent yields averaging north of 8%...not an easy thing to find!

Bottom line, if PBDC drops below $29 I’ll top it back up to 5% of the portfolio (it did that briefly last week, but I missed it).

The October 26th episode on the Armchair Income channel will look further into the recent BDC pullback.

Trades

Sold UTG (2.18% Allocation)

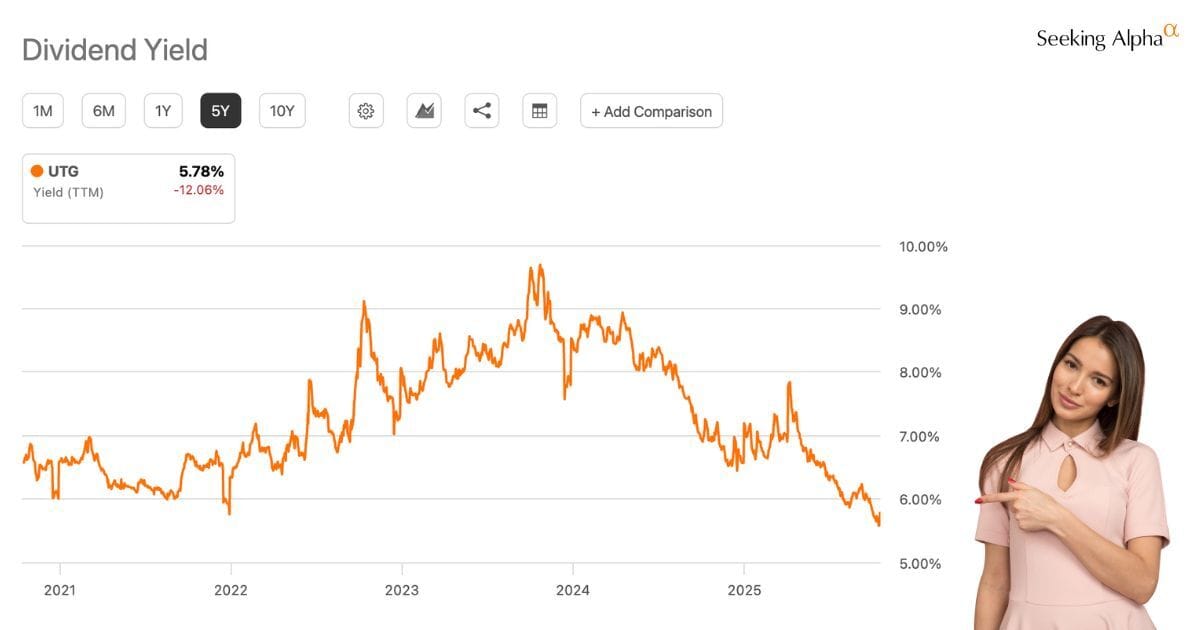

This is my favorite utility fund, but it has become too popular! The yield has fallen to less than 6% because of price appreciation. A total return of 30% over the past year is incredible!

Most of the total return was driven by price appreciation

But the price appreciation caused the UTG yield to fall below 6%

Utilities offer some upside, because AI is driving more demand for power, so UTG may continue to climb. However, I’m not a growth investor, nor a speculator, so I’m moving the gains over to another opportunity that pays a higher yield. That brings us to…

Bought UTF (2.18% Allocation)

UTF is also a utility fund, and to a large extent, a competitor to UTG. This review compares UTF and UTG.

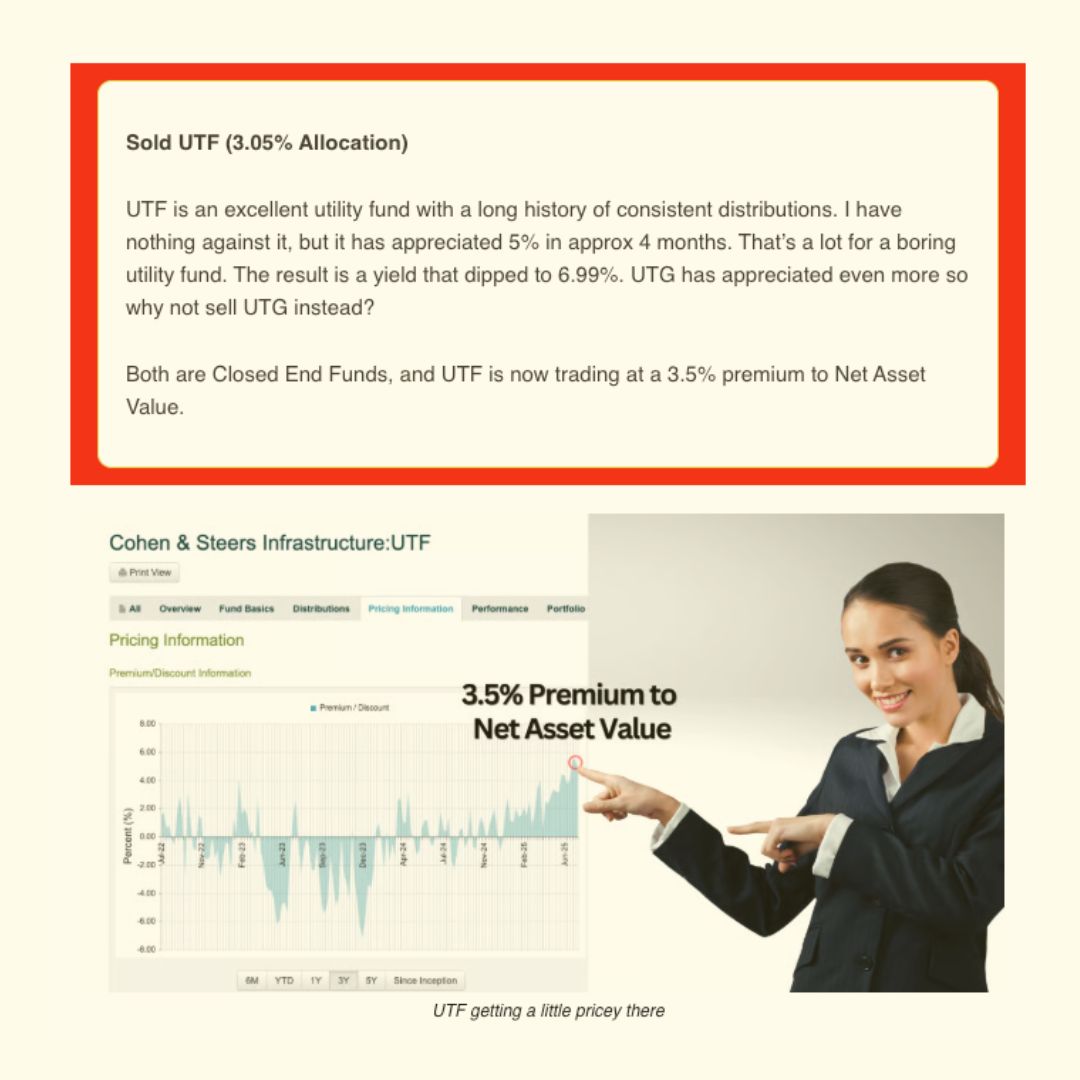

I sold UTF last July because it was trading at a premium to NAV, and the yield fell below 7%.

This was the July post about UTF trading at a premium. Things have changed…

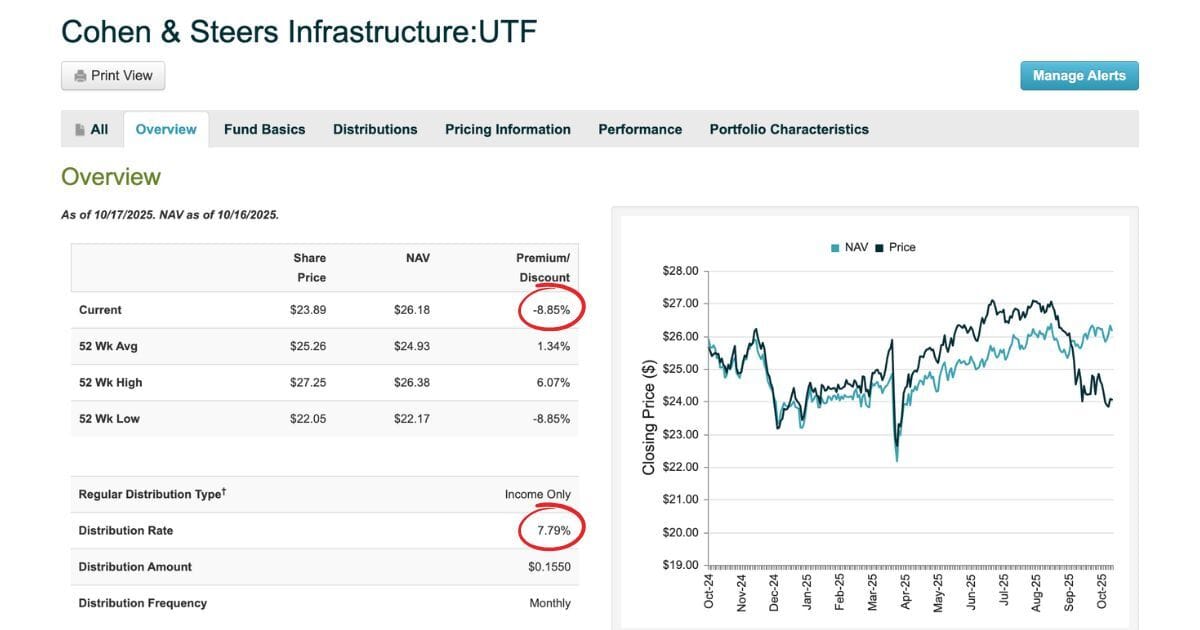

Thanks to a recent Rights Offering, the price has fallen, and the yield is back up over 7% again. Rights Offerings create confusion, and require investors to make decisions about their holdings. As outlined in last month’s edition, I decided to wait until it passed.

Apart from the higher yield, it’s also worth noting that UTF has shifted from trading at a premium to its Net Asset Value (NAV), to a discount of 8.85%. Buying a fund at a discount to NAV means you receive a higher yield, than if you paid full price for the assets. In this case, the fund generates a 7.1% yield on its assets.

The 8.85% discount translates to a yield for the investor of 7.79%.

This private community is for income investors to exchange ideas, and will re-open to new members soon. Stay tuned for announcements…

Recent Videos

(Published Since the Last Edition of Armchair Insider)

Armchair Insider Portfolio

|

(*If you have difficulty opening the portfolio directly from your email, try opening the newsletter in a browser, then opening the portfolio)

Basic Resources

Dividend Tracker: Snowball

Primary Research Tool: Seeking Alpha

How I Use Seeking Alpha to Find Income Stocks/Funds: Video Tutorial

Closed End Fund Database: CEF Connect

Advanced Resources

How to Buy Preferred Shares: 67 Page Guide to Preferred Shares

Preferred Stock Profiles (Rates, Call Dates, etc): Quantum

BDC Weekly Insights Report: Raymond James

BDC, Preferred Stock, & Bond News, Portfolios, and Trades: Systematic Income Investing

Thanks for stopping by…see you in the next issue!

Regards,

Armchair Income

Disclaimer: I’m sharing information about my investments, but I’m not making any recommendations to you to buy or sell anything. Each investor has their own goals, risk tolerance, and timeline, and must make their own investments decisions…then take responsibility for those decisions. I’m not a financial advisor, and I don’t advise anybody regarding their investments. If the information in this newsletter is useful or helpful in any way, then my goal is achieved :) Some of the links provided above may be associated with affiliate programs. If so, use of those links will not incur any additional cost to the user (and will, in many cases, provide a benefit to the user) and may result in a referral commission to this newsletter.