- Armchair Insider

- Posts

- Taking Some Profits!

Taking Some Profits!

1 Sale, 1 Reduction, 1 Buy, 1 Increase

There’s a lot of “Fed Cut! Do This!” content on social media. I don’t think it's necessary to make radical changes every time the Fed adjusts rates.

This month, I’m taking profits on a couple of funds and redeploying to higher yield, or (potentially) higher performance. The portfolio yield is currently 10.81%.

Rate Cuts: Are you Selling BDC’s and CLO’s?

The short answer is no, or not yet.

The longer answer is that I’m in no rush to make dramatic changes because 1/ The market prices expected changes like this into the relevant stocks/funds and 2/ A 0.25% cut barely moves the needle. A year ago, the Fed made a series of cuts totaling 1.00% and floating rate assets like CLO’s, BDC’s, loan portfolios, and floating rate preferred shares did not crash. The prices were largely unaffected.

Here’s a CLO example, CLOZ:

A full 1.00% reduction was barely a hiccup

However, the rates cuts did reduce the distributions for CLOZ:

Income reduced slightly for all variable rate credit funds

In round numbers, the CLOZ yield fell from approx 9% to 8%. That’s nothing to celebrate, but it has to be taken in the context of all other income investments. Fed rate cuts also reduced the yield on money market funds, short term treasuries, etc. So 8% sounds like a downgrade, but relative to “risk free” alternatives, the “risk premium” remained constant.

As a reminder, this was for a 1.00% reduction in the Fed Funds rate. We don’t know if, or when, rate cuts of that scale will occur in the near term.

What about fixed income investments?

Lower interest rates WILL have an effect on the price of fixed rate investments (eg. corporate bonds, and fixed rate preferred shares, not withstanding call risk). Everything else being equal, the price of fixed rate investments goes up, when interest rates go down.

If you’re worried about severe interest rate cuts, you could speculate on fixed rate investments, as their distributions will remain constant in dollar terms, and their price is likely to increase if rates fall.

For example, the new fixed rate preferred stock, NLY.PR.J from Annaly Capital (a mortgage REIT), pays 8.875% fixed (as calculated on a $25 par value). There’s no call risk for 5 years (“call risk” means the issuer can force you to sell at the $25 par value). The lower the Fed Funds rate goes, the more desirable that 8.875% of $25 will become. In other words, rate cuts would push the price higher than $25.

NLY.PR.J Terms & Conditions:

I continue to hold the sister preferred stock, NLY.PR.F. It’s a variable distribution and the yield is higher at 9.33%. Switching to the certainty of NLY.PR.J means immediately forgoing some income. I’m in no rush, but it's worth keeping an eye on these things.

Trades

Sold PDI (1% Allocation)

Not easy to sell a fund with such a high yield (13.43%) and a long history of consistent distributions. However, PDI has been on a hot run, and is now priced at a premium of 17% over its Net Asset Value (NAV). That’s rich!

Add to this that it’s 33% leveraged, and it’s a recipe for volatility. In other words, it's susceptible to major price drop on any bad news. I’m not really a trader, but this one looks too obvious to ignore. Will happily buy it back at a lower price.

Reduced UTG (From 4% to 2% Allocation)

I want exposure to utilities but lately…so does everybody else! UTG has delivered a total return of more than 31% this past year, versus 18% for the S&P 500. There’s a lot of excitement around AI and power generation. That’s great, but the lower the yield goes (currently 6%), the less desirable UTG becomes.

UTG has performed more like a chip maker than a utility fund

It’s tempting to buy back competing utility fund, UTF, on its recent price dip (yielding 7.5%). However, the dip was driven by a rights offering, and that means a lot of uncertainty about the short term price of the fund. Will keep an eye on UTF, and see how it shakes out after the rights offering has expired.

Speaking of rights offerings, midstream fund EMO (yielding 9.3%) recently dipped for that reason. Also tempting, but I’ll wait to see how that one shakes out too.

Bought QDVO (2% Allocation)

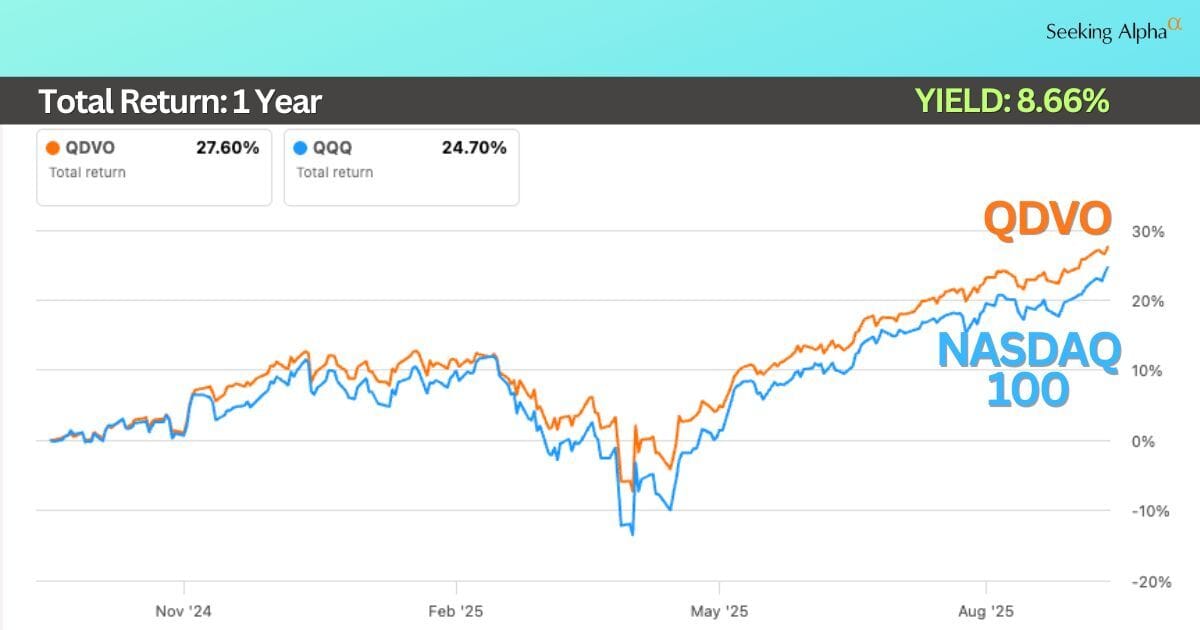

This tech focused covered call fund came out of the gates guns a blazin’, but I waited for it to celebrate its 1st birthday before posting a review. It’s a rare thing for a covered call fund (which distributes an 8.66% yield) to outperform its benchmark, the NASDAQ 100 (0.47% yield).

QDVO is off to a fantastic start, beating the NASDAQ 100 in its first year

Increased IYRI (From 1.78% to 2.81%)

Real estate has been in the dog house ever since the Fed hiked rates. Now that rates appear to be on the way down again (no guarantees of course), real estate stands to benefit. This NEOS covered call fund based on the Dow Jones U.S. Real Estate Capped Index, is an easy way to obtain real estate exposure in the form of income. Don’t expect much, if any appreciation, but with an 11% yield, I don’t need it.

Click Here for an Interview with the IYRI Fund Manager, Garrett Paolella.

This private community is for income investors to exchange ideas, and will re-open to new members soon. Stay tuned for announcements…

I used to scroll through Schwab, Etrade, and Interactive Brokers portfolio screens, and then try to figure out who was going to pay me what, and when. Much easier to have 1 clean dashboard that’s designed for income investors.

I usually sort by yield and price, to get a quick overview of how the market is affecting my portfolio. Occasionally they have sales, and the current one ends September 24th.

Existing customers can ALSO take advantage of this promotion! If you already have Snowball, you can extend an existing subscription early; just click "Unsubscribe" and Subscribe again at the Autumn Sale rate. (maximum subscription period is 720 days)

Recent Videos

(Published Since the Last Edition of Armchair Insider)

Armchair Insider Portfolio

|

(*If you have difficulty opening the portfolio directly from your email, try opening the newsletter in a browser, then opening the portfolio)

Basic Resources

Dividend Tracker: Snowball

Primary Research Tool: Seeking Alpha

How I Use Seeking Alpha to Find Income Stocks/Funds: Video Tutorial

Closed End Fund Database: CEF Connect

Advanced Resources

How to Buy Preferred Shares: 67 Page Guide to Preferred Shares

Preferred Stock Profiles (Rates, Call Dates, etc): Quantum

BDC Weekly Insights Report: Raymond James

BDC, Preferred Stock, & Bond News, Portfolios, and Trades: Systematic Income Investing

Thanks for stopping by…see you in the next issue!

Regards,

Armchair Income

Disclaimer: I’m sharing information about my investments, but I’m not making any recommendations to you to buy or sell anything. Each investor has their own goals, risk tolerance, and timeline, and must make their own investments decisions…then take responsibility for those decisions. I’m not a financial advisor, and I don’t advise anybody regarding their investments. If the information in this newsletter is useful or helpful in any way, then my goal is achieved :) Some of the links provided above may be associated with affiliate programs. If so, use of those links will not incur any additional cost to the user (and will, in many cases, provide a benefit to the user) and may result in a referral commission to this newsletter.