- Armchair Insider

- Posts

- I Need More Energy...& Less Volatility

I Need More Energy...& Less Volatility

2 Sales and 2 Buys

A Momentary Lapse of Chaos

Almost a month since the last edition of Armchair Insider and no new wars, and no new tariff chaos (that the market cares about). Yay. A couple of tweaks this month:

1/ UTF’s yield dipped below 7% due to price appreciation. I’m keeping its utility cousin from another mother, UTG, but swapping UTF for my first Midstream Energy fund, NML, yielding 7.99%.

2/ Preferred Shares and Baby Bonds offer steady income and low volatility. Swapping NYMTI for DX.C, because it demonstrated impressively low volatility during the April Tariff Chaos.

The trades below increased the portfolio yield from 11.03% to 11.08%.

Trades

Sold UTF (3.05% Allocation)

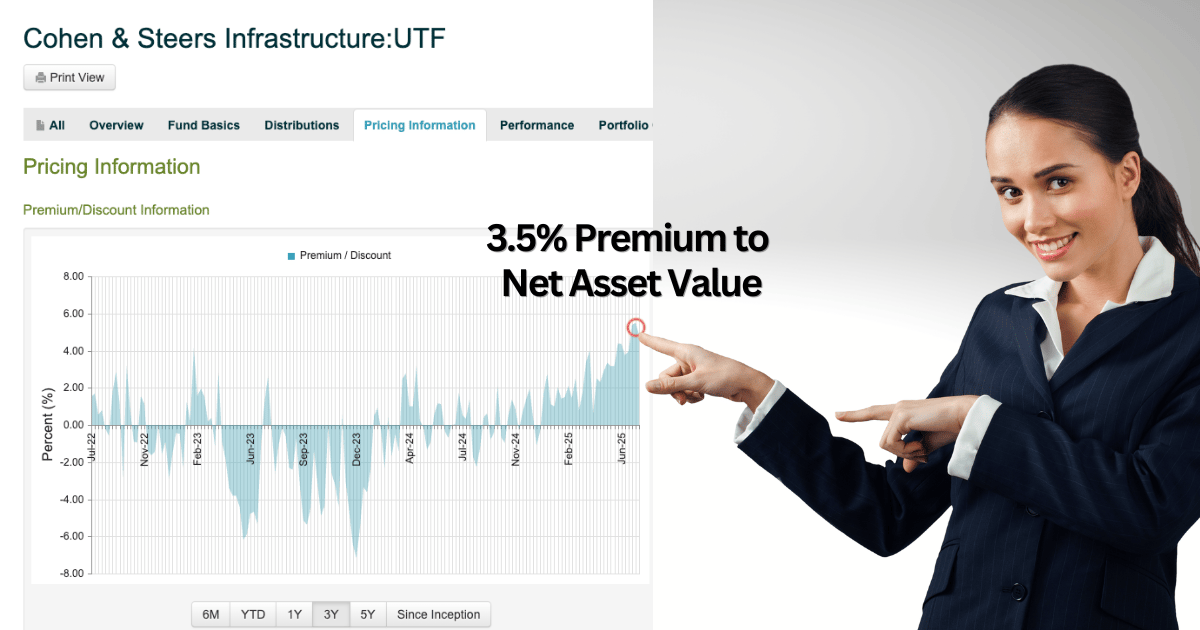

UTF is an excellent utility fund with a long history of consistent distributions. I have nothing against it, but it has appreciated 5% in approx 4 months. That’s a lot for a boring utility fund. The result is a yield that dipped to 6.99%. UTG has appreciated even more so why not sell UTG instead?

Both are Closed End Funds, and UTF is now trading at a 3.5% premium to Net Asset Value.

UTF getting a little pricey there

By contrast, UTG is trading at a more modest 0.75% premium to NAV. The higher the premium (relative to its historical average), the more risk that it will over correct during a market pullback. UTG and UTF were explained in this review.

Sold NYMTI (2.65% Allocation)

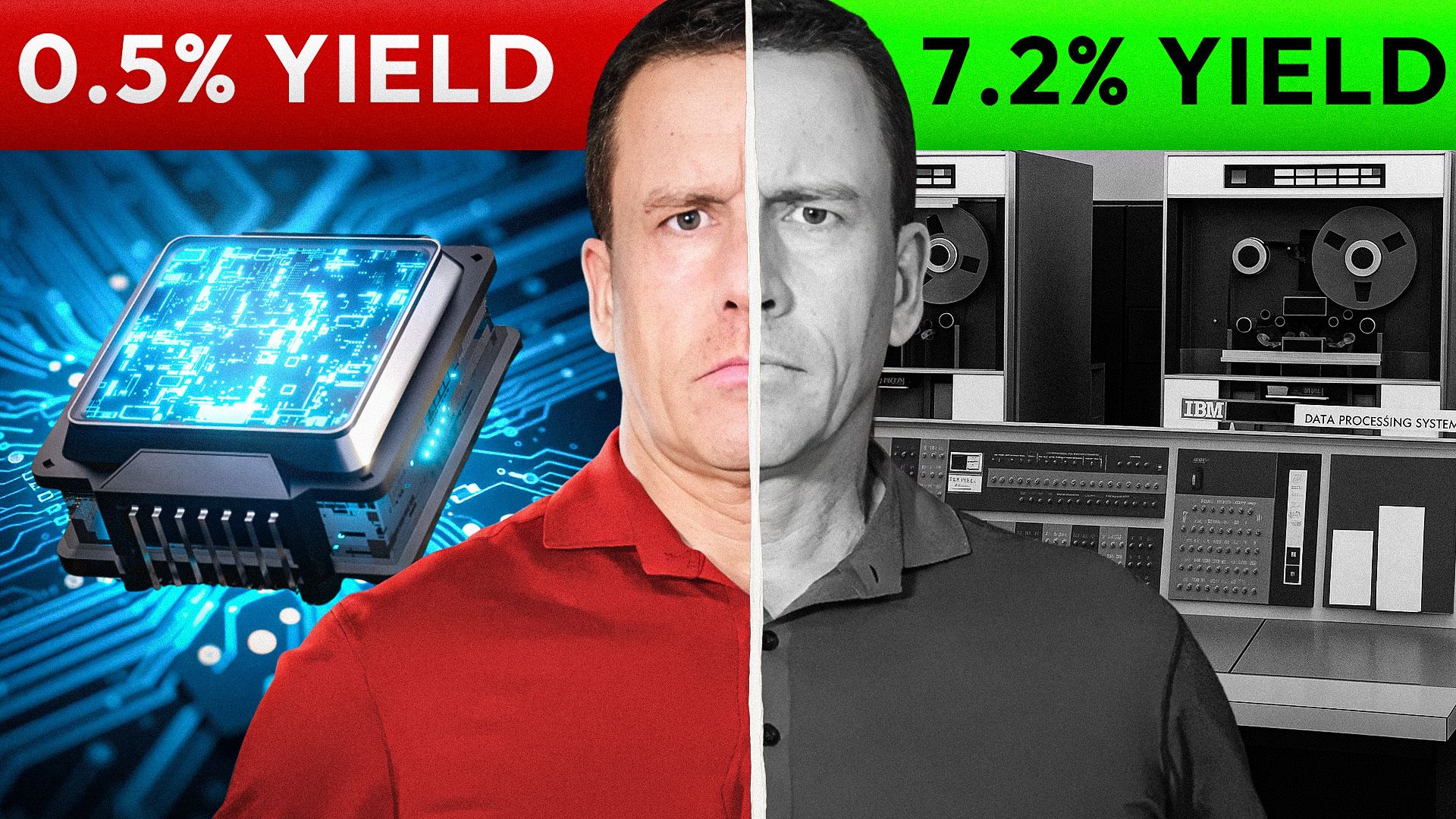

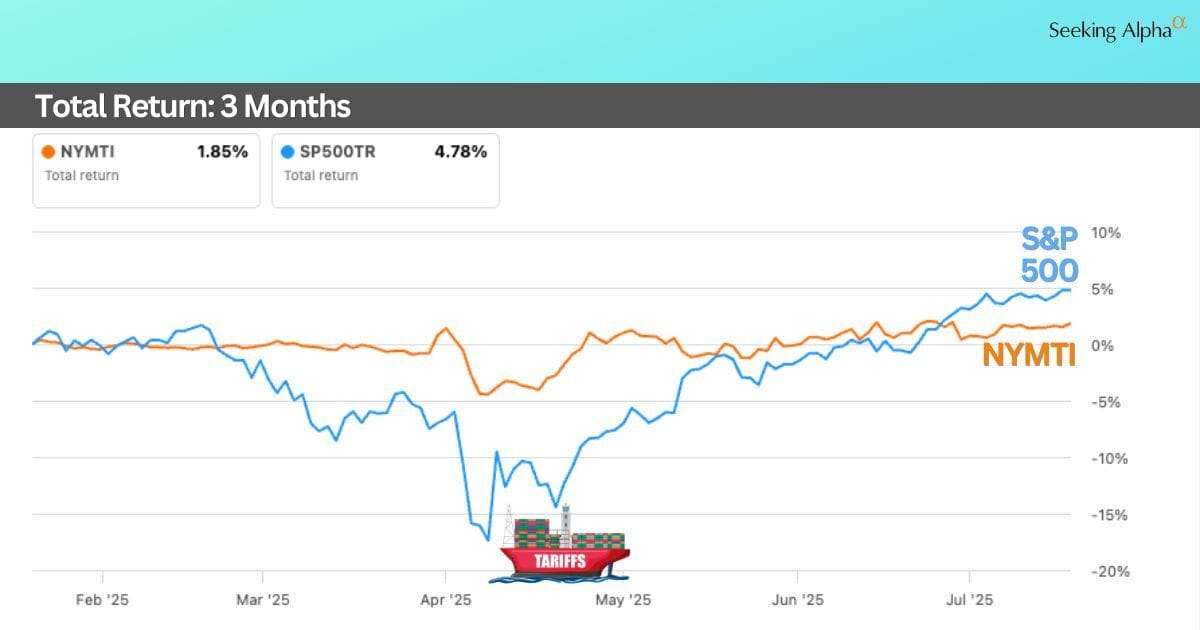

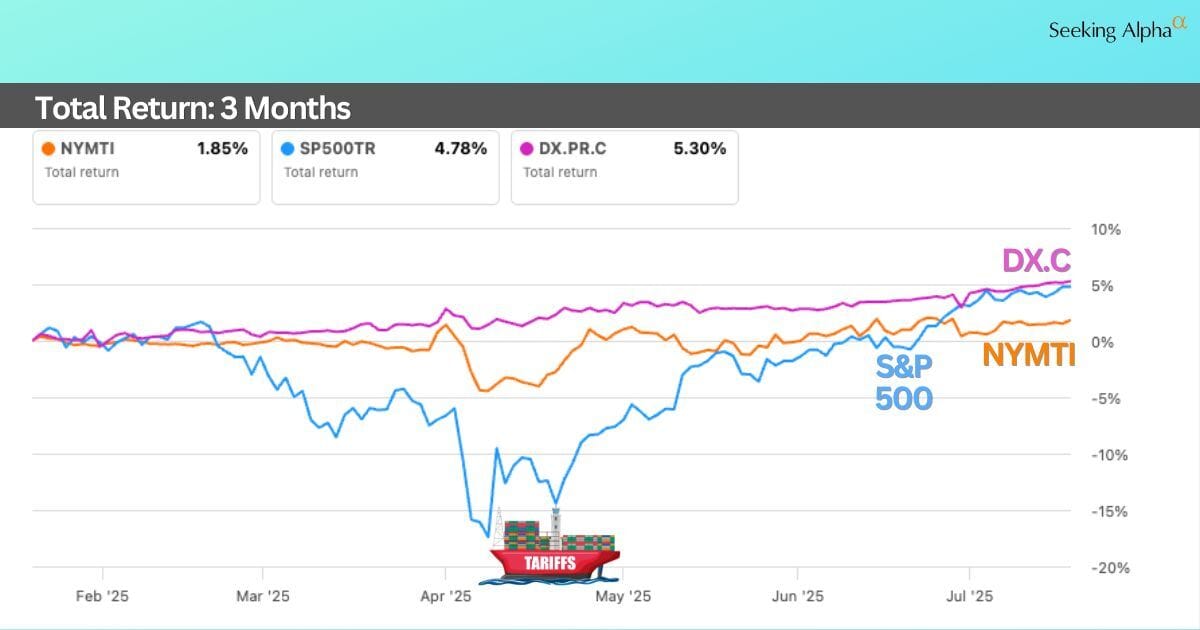

This Baby Bond (low priced corporate bond targeted at retail investors) offers a juicy yield of 9.28%, and less volatility than the stock market (ie S&P 500). That lower volatility can come in handy if there’s a market correction, and you want to sell something that didn’t drop, to buy something that did.

NYMTI held up OK, but it skipped a beat

The April tariff chaos showed that NYMTI did an “OK” job of consistent income with low volatility. However, the DX.C preferred shares from Dynex Capital, did a much better job. Rock solid!

DX.C didn’t get “tariffs are scary” memo

Bought NML (2.7% Allocation)

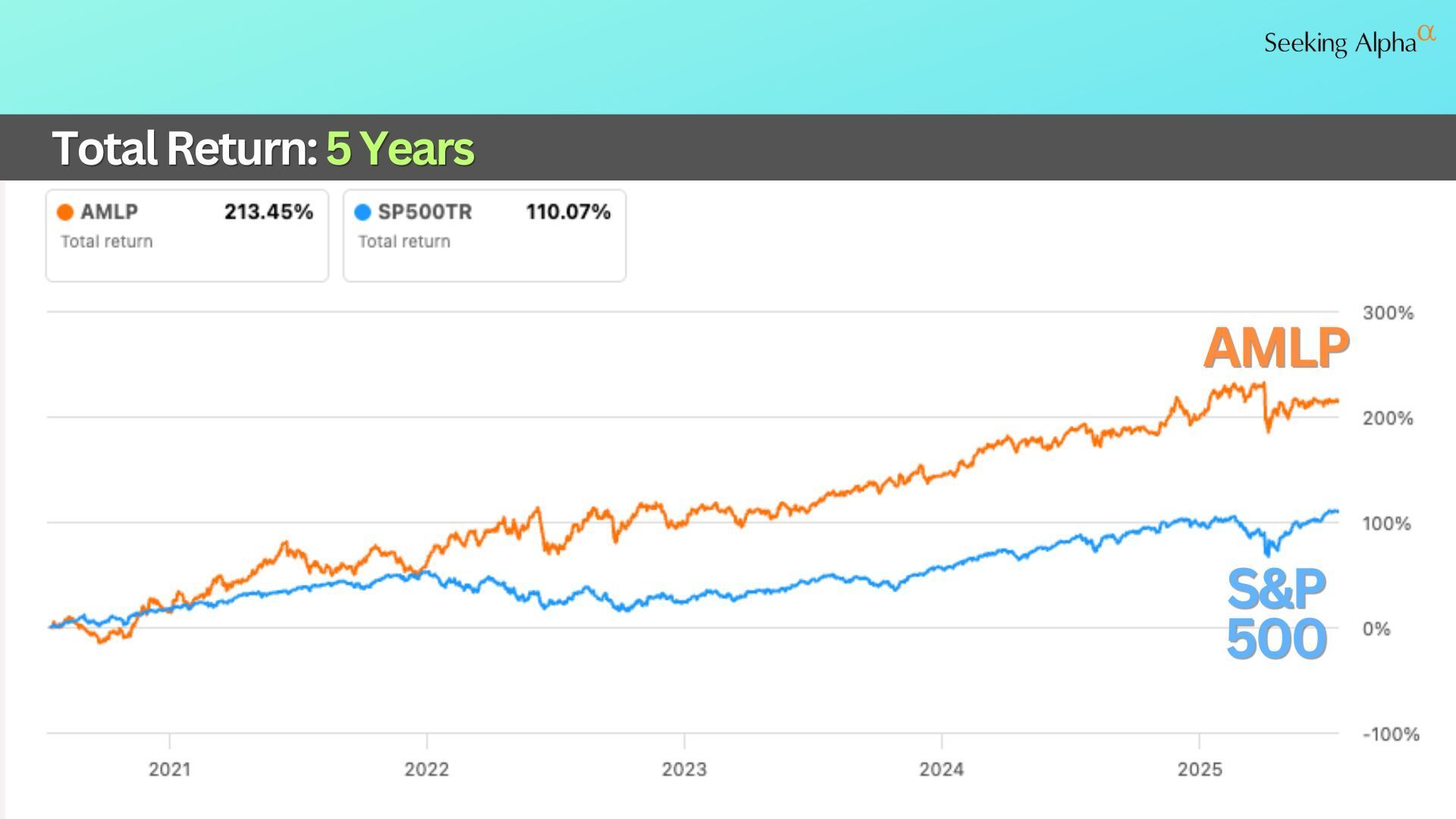

The 10 year total return for Midstream Energy sector looks terrible…

Midstream Sector as represented by AMLP which tracks the Alerian MLP Infrastructure Index

But the 5 year total return looks amazing!

After Covid 2020, the Midstream Energy sector took off!

What happened?

The rise of the North American shale industry created an oversupply, that led to a price war with OPEC in late 2014. Then Covid collapsed the demand for energy. Two giant shocks to the energy sector that will be covered in a future video episode, scheduled to air on July 27th.

Midstream operators do the boring work of transporting, storing, and processing gas and oil products after they’re extracted from the ground, but before they’re refined into finished products like gasoline, and delivered to your gas station.

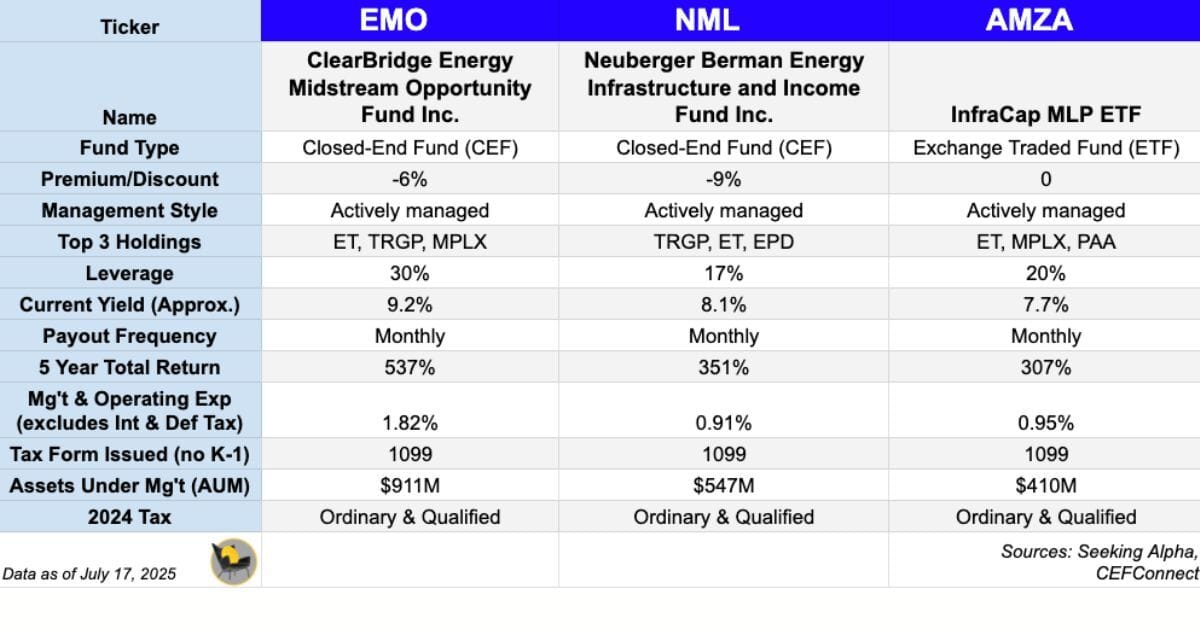

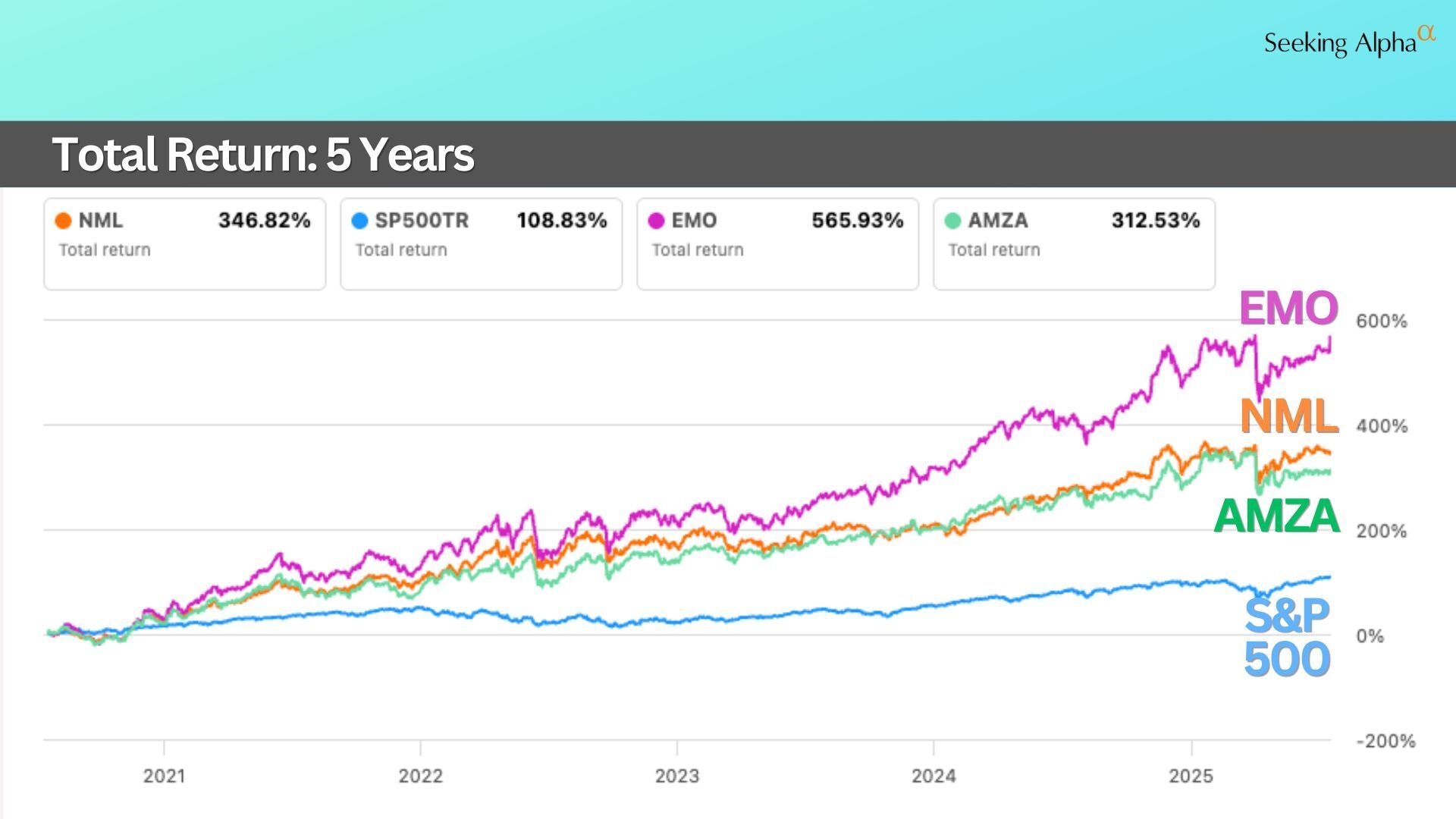

NML yields 7.99% and is my first foray into Midstream funds (I’ve owned HESM, an individual Midstream operator in the past). I’m also keeping an eye on two other funds that have performed well (post Covid): EMO and AMZA.

EMO has outperformed NML over the past 5 years for total return, however it uses more leverage, and comes with a higher management fee.

EMO, NML, and AMZA are on a surprisingly good 5 year run.

Bought DX.C (3.0% Allocation)

Dynex Capital’s Series C preferred shares currently yield 9.81% and as explained above, have demonstrated low volatility. The issuer of the preferred stock, Dynex Capital, is a Mortgage REIT that pays a yield of 16.2%. As mREIT’s go, Dynex is a decent operator. However, I find the common shares for this sector too risky/volatile for my taste. The higher yield from the common stock looks enticing, but is exposed to a much higher risk of a dividend reduction and/or price correction. As long as the common stock pays a common dividend…any dividend, the preferred dividend is safe. Dynex Series C preferred shares were reviewed in this video.

I used to scroll through Schwab, Etrade, and Interactive Brokers portfolio screens, and then try to figure out who was going to pay me what, and when. Much easier to have 1 clean dashboard that’s designed for income investors.

I usually sort by yield and price, to get a quick overview of how the market is affecting my portfolio. Occasionally they have sales, and the current one ends July 23rd. Click here for the discount.

Recent Videos

(Published Since the Last Edition of Armchair Insider)

Armchair Insider Portfolio

|

(*If you have difficulty opening the portfolio directly from your email, try opening the newsletter in a browser, then opening the portfolio)

Basic Resources

Dividend Tracker: Snowball

Primary Research Tool: Seeking Alpha

How I Use Seeking Alpha to Find Income Stocks/Funds: Video Tutorial

Closed End Fund Database: CEF Connect

Advanced Resources

How to Buy Preferred Shares: 67 Page Guide to Preferred Shares

Preferred Stock Profiles (Rates, Call Dates, etc): Quantum

BDC Weekly Insights Report: Raymond James

Thanks for stopping by…see you in the next issue!

Regards,

Armchair Income

Disclaimer: I’m sharing information about my investments, but I’m not making any recommendations to you to buy or sell anything. Each investor has their own goals, risk tolerance, and timeline, and must make their own investments decisions…then take responsibility for those decisions. I’m not a financial advisor, and I don’t advise anybody regarding their investments. If the information in this newsletter is useful or helpful in any way, then my goal is achieved :) Some of the links provided above may be associated with affiliate programs. If so, use of those links will not incur any additional cost to the user (and will, in many cases, provide a benefit to the user) and may result in a referral commission to this newsletter.