- Armchair Insider

- Posts

- Goldman Shines!

Goldman Shines!

2 Sales, 1 Increase, 1 Buy

Covered Call ETF Competition Heats Up

Converting S&P 500 / NASDAQ gains (and volatility) into monthly income is a huge hit with retirees. The 8-14% yields are enticing, but it’s still early days. As more data comes in, I continue to make adjustments…

J.P. Morgan are the big dogs in this space,…$70 billion between JEPI and JEPQ. Competition is healthy, and now we’re spoiled for choice. I reviewed Goldman’s GPIX back in June 2024, and it continues to shine. Time to put some money to work with them.

Upstart, NEOS, continues to gain market share as the option income specialist. Back to a full allocation for QQQI.

THQ has been a stinker lately. Mostly because the healthcare sector has struggled with fears over government regulation. Warren Buffett’s recent purchase of 5 million United Health shares might signal the bottom. UNH is THQ’s second largest holding, so it enjoyed a small bounce on the news. I don’t love the healthcare sector, but maintain a small exposure for diversification. No changes to THQ.

The portfolio yield remains at 11.2%.

Buffett’s UNH purchase breathes some life back into the Healthcare sector

THQ received a Buffett Bounce

Trades

Sold JEPQ (4.67% Allocation)

JP Morgan’s JEPQ ETF has performed well since its 2022 inception. However, recently it fell behind the competition, including QQQI.

JEPQ fell behind the competition

NEOS’ QQQI ETF is newer but follows the same strategy as its older sibling, SPYI. I think NEOS’ active management of its option trades in-house has proven more effective than JP Morgan’s strategy of outsourcing its covered call trades to banks.

Also, NEOS’ option trades are transparent, their option holdings are available on the website. JP Morgan’s Equity Linked Notes however, do not disclose their option trades. Lastly, QQQI’s ability to treat a large portion of its distributions as Return of Capital is consistently tax efficient.

Sold JEPI (2.5% Allocation)

JEPI is designed to be less volatile than the S&P 500 upon which it is based. It was slightly less volatile during the April tariff correction.

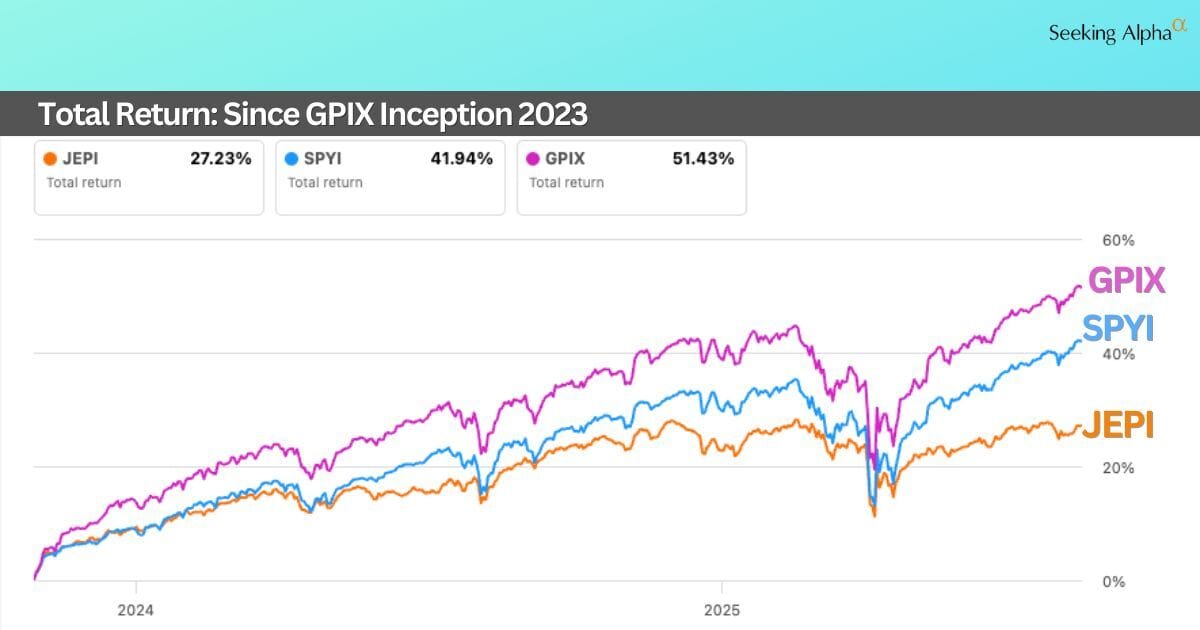

However, that slight reduction in volatility isn’t enough to warrant a long term spot in the portfolio. GPIX has delivered superior results, as we’ll see when we get to it in a moment…

Slightly less volatile but nothing to get excited about

Increased QQQI (From 2.64 to 5% Allocation)

For the reasons outlined above, I reallocated from JEPQ to QQQI.

Bought GPIX (4.81% Allocation)

Goldman’s S&P 500 covered call fund was launched in 2023, and has proven itself competitive so far. To learn more about GPIX, check out this review. I continue to hold SPYI as it is more transparent with its option strategy, and has a longer history. Also, GPIX’s 8% yield comes with more appreciation and SPYI’s 12% yield delivers more income, making for a nice blend.

Goodbye JEPI, Hello GPIX

Want To Go Deeper?

Love income investing and want more updates, more investing ideas?

I do, and for the past 2-3 years I’ve been getting some of my best tips/info from Systematic Income Investing by ADS Analytics. After much back and forth, they’ve agreed to provide Armchair Insiders with their lowest rate.

A subscription gets you access to their huge BDC, Preferred Share, CEF, and Baby Bonds databases, along with daily market updates, income portfolios, and tons of in-depth income investment articles.

I’ve attached a couple of recent examples from my email Inbox…

|

|

Rates:

Systematic Income Investing on Seeking Alpha: $499/year

ADS Analytics Website: $29/month

Armchair Insider Discounted Rate: $27/month

Discount Link: https://armchairincome.link/siin

Disclosure: Purchases made via the affiliate link may result in a small commission to Armchair Insider, which helps fund the channel, and the newsletter. To the best of my knowledge, the Armchair Insider discount provides you with the best price available.

Recent Videos

(Published Since the Last Edition of Armchair Insider)

Armchair Insider Portfolio

|

(*If you have difficulty opening the portfolio directly from your email, try opening the newsletter in a browser, then opening the portfolio)

Basic Resources

Dividend Tracker: Snowball

Primary Research Tool: Seeking Alpha

How I Use Seeking Alpha to Find Income Stocks/Funds: Video Tutorial

Closed End Fund Database: CEF Connect

Advanced Resources

How to Buy Preferred Shares: 67 Page Guide to Preferred Shares

Preferred Stock Profiles (Rates, Call Dates, etc): Quantum

BDC Weekly Insights Report: Raymond James

Thanks for stopping by…see you in the next issue!

Regards,

Armchair Income

Disclaimer: I’m sharing information about my investments, but I’m not making any recommendations to you to buy or sell anything. Each investor has their own goals, risk tolerance, and timeline, and must make their own investments decisions…then take responsibility for those decisions. I’m not a financial advisor, and I don’t advise anybody regarding their investments. If the information in this newsletter is useful or helpful in any way, then my goal is achieved :) Some of the links provided above may be associated with affiliate programs. If so, use of those links will not incur any additional cost to the user (and will, in many cases, provide a benefit to the user) and may result in a referral commission to this newsletter.